Chrono

2025

Q2 2025

Monitor is granted a one-year extension to the current licence period, now extended until Oct 2026, allowing time to plan and carry out an airborne high-resolution gravity, magnetic, and radiometric survey covering 6,000 line-km, scheduled for Q3 2025. TAC approved PEL 93 Work Program & Budget through to 31 Dec 2025, supporting Monitor’s planned exploration activities.

Q1 2025

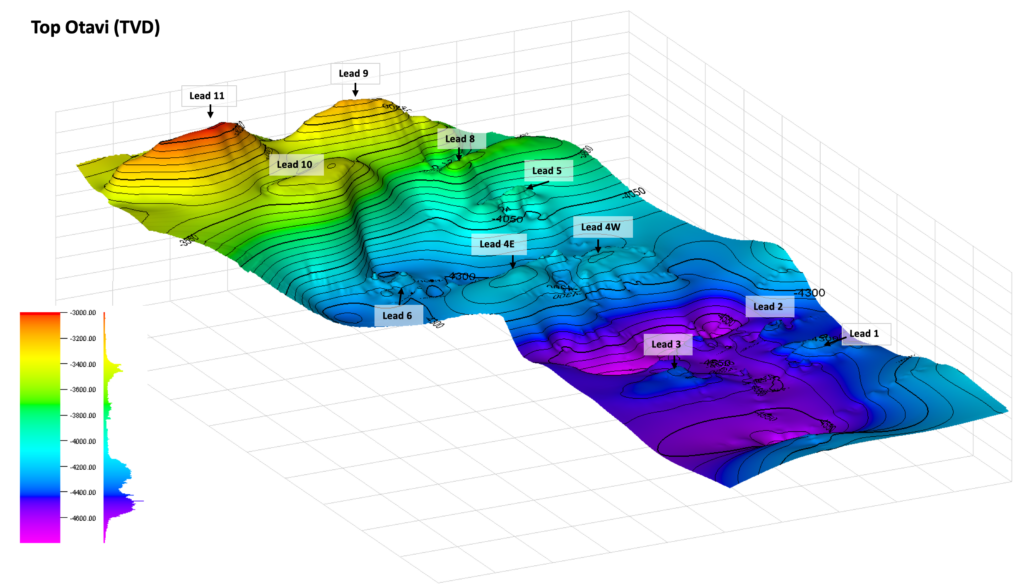

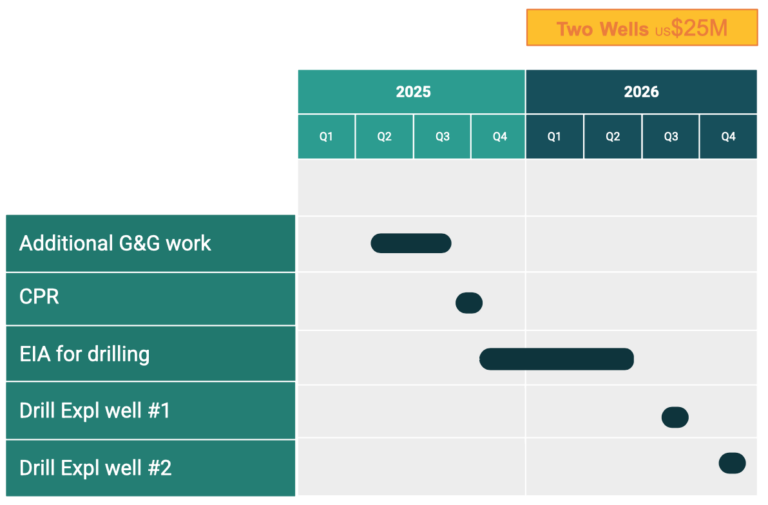

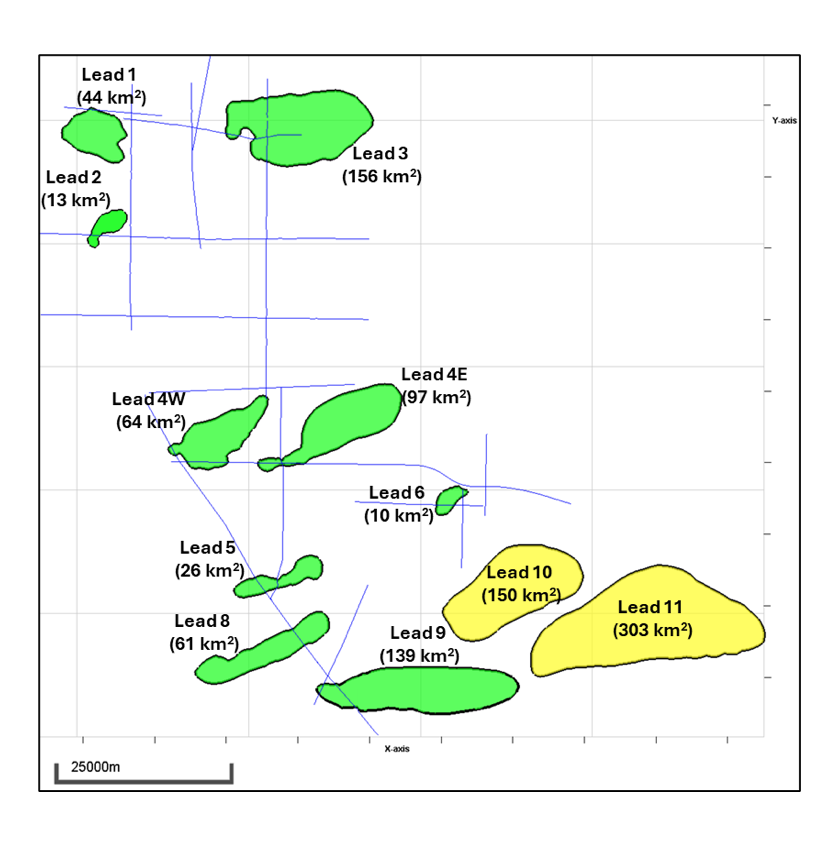

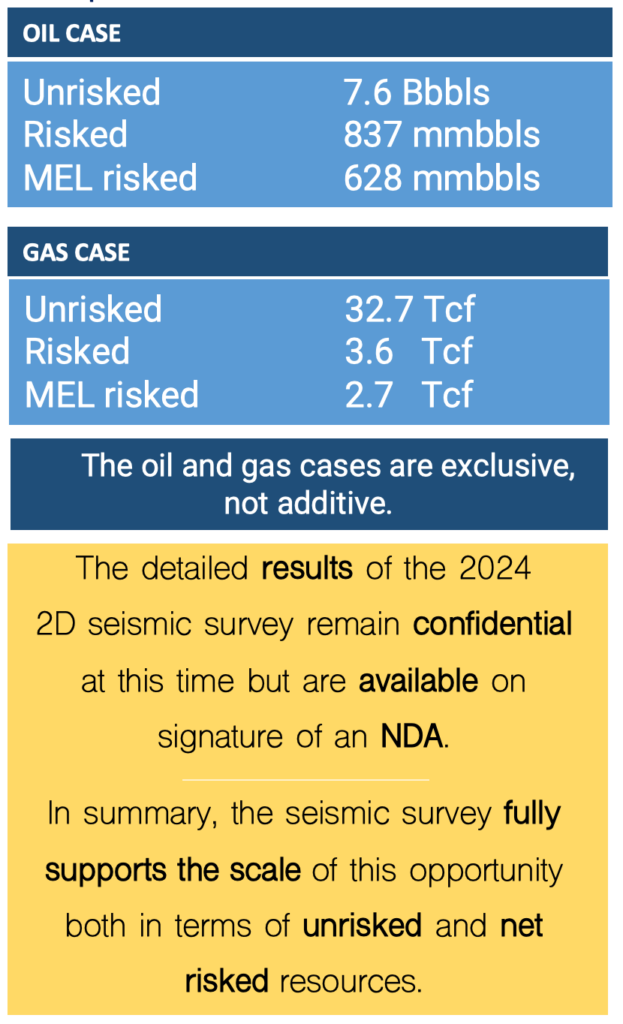

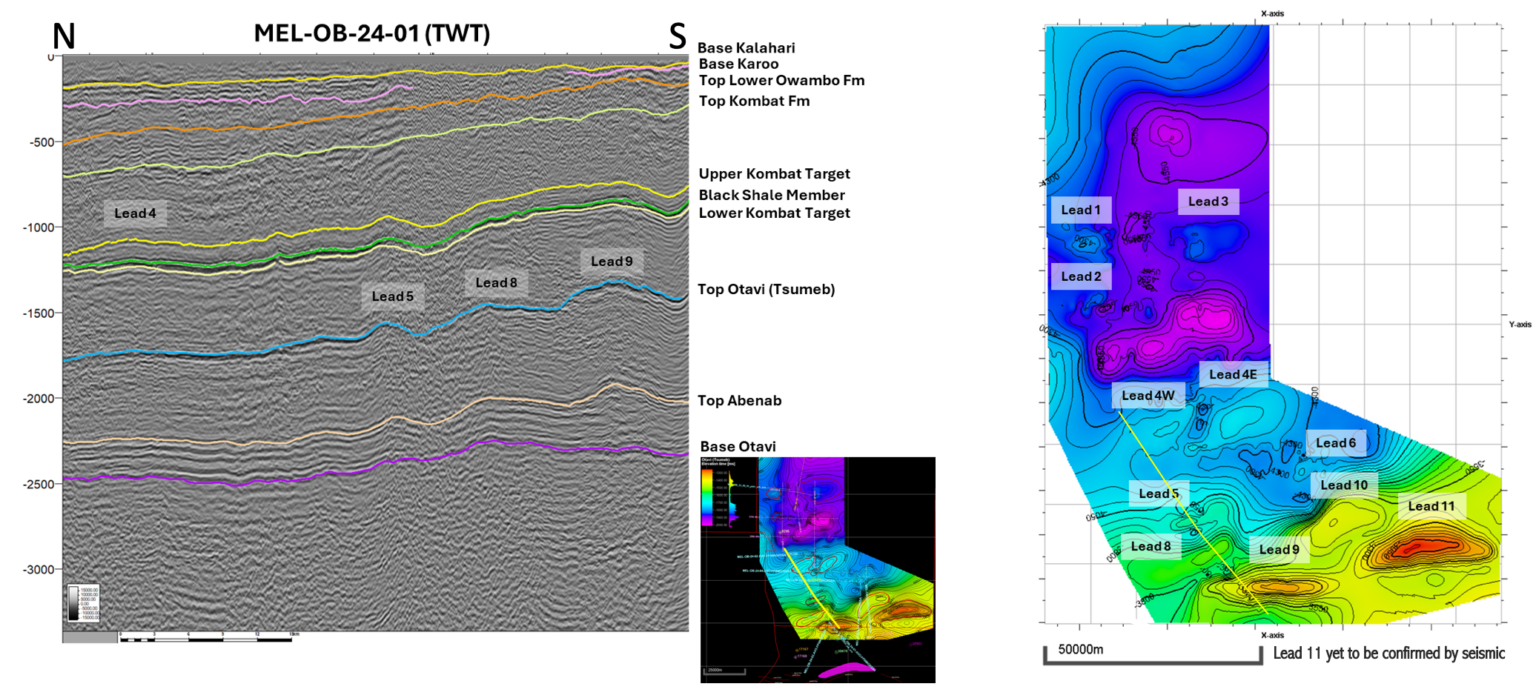

Following interpretation of the 200 km 2D seismic and integration, a new set of volumetric calculations reaffirm the high potential of the acreage, highlighting 11 distinct leads with significant hydrocarbon prospectivity and confidence in the scale and quality of the subsurface structures. Detailed volumetric data is disclosed to potential investors in advance towards drilling operations.

2024

Q4 2024

Results of 2D seismic confirm prospectivity of up to 11 leads. One structure has an area in excess of 100km2 with significant vertical relief andclear access to hydrocarbon chargefrom source rocks.

New Petroleum Agreement signed in the Nama Basin, onshore Central Namibia.

Q3 2024

203 line km of 2D seismic completed deploying vibroseis to improve data quality. Acquisition in June-July 2024: on time, on budget, no incidents.

First results expected in October 2024.

Q2 2024

Tender invitation to selected companies to provide 2D seismic bids for 200 km. Contract signature: May 2024. Acquisition: July-August 2024. First results: Sept-October 2024.

New licence negotiated in Nama basin, onshore Central Namibia. Procedure for signature.

Q1 2024

20% Working Interest transferred to 88 Energy. Invitation to Tender out to selected bidders for min.200 line-km of 2D seismic acquisition. New Work Program & Budget for the First Renewal Period agreed with license partners. New exploration licences under negotiation in and outside Namibia.

2023

Q3 2023

The new 2D seismic confirmed the westerly dip on the AOI 02 structure, and connects with the existing seismic grid in AOI 00, where a distinct high is observed and additional structures are mapped.

Q2 2023

Acquired two lines for a total of 60 km of new 2D seismic and tested the Accelerated Weight Drop (AWD) source in our geological setting.

Q1 2023

Following the acquisition of 2D seismic over their acreage, ReconAfrica have now recognised the very significant potential of the Damara fold play which has always been Monitor’s primary focus.

2022

Q3 2022

ECC (Environmental Clearance Certificate) signed, valid for 3y, granting authorisation to commence 2D seismic. Change of velocity in depth calculation by means of using passive seismic dataset from 2018.

Q2 2022

Completion of EIA and EMP. Ready to start with 2D seismic preparations for operations. Initial Exploration Period of our PA was extended with 12 months, until 02 Oct 2023.

Q1 2022

Commencement of Environmental Impact Assessment (EIA)and Environmental Management Plan (EMP), authorization expected end Q2 2022, and schedule to proceed with 2D seismic operations immediately after.

2021

Q4 2021

Derisked our prospects further by purchasing additional G & G, namely the well data of Etosha 5-1 and ST-1 as well as 750 km of 2D seismic lines to tie to our AOIs.

Q3 2021

Working Petroleum System ReconAfrica announce drilling results proving a working petroleum system in the Owambo basin, significantly de-risking MEL’s acreage.

2018 - 2020

Q2 2019

Data Integration Report completed by Pioneer and resource estimate numbers are calculated.

Q1 2019

Results from passive seismic spectroscopy and remote sensing are available, and in process of combination with existing data, such as conventional seismic and gas shows for the area.

Q4 2018

Remote Sensing and Passive Seismic surveys carried out.

Q3 2018

Monitor signs the Petroleum Agreement for blocks 1717 and 1817. PEL 93 is assigned.

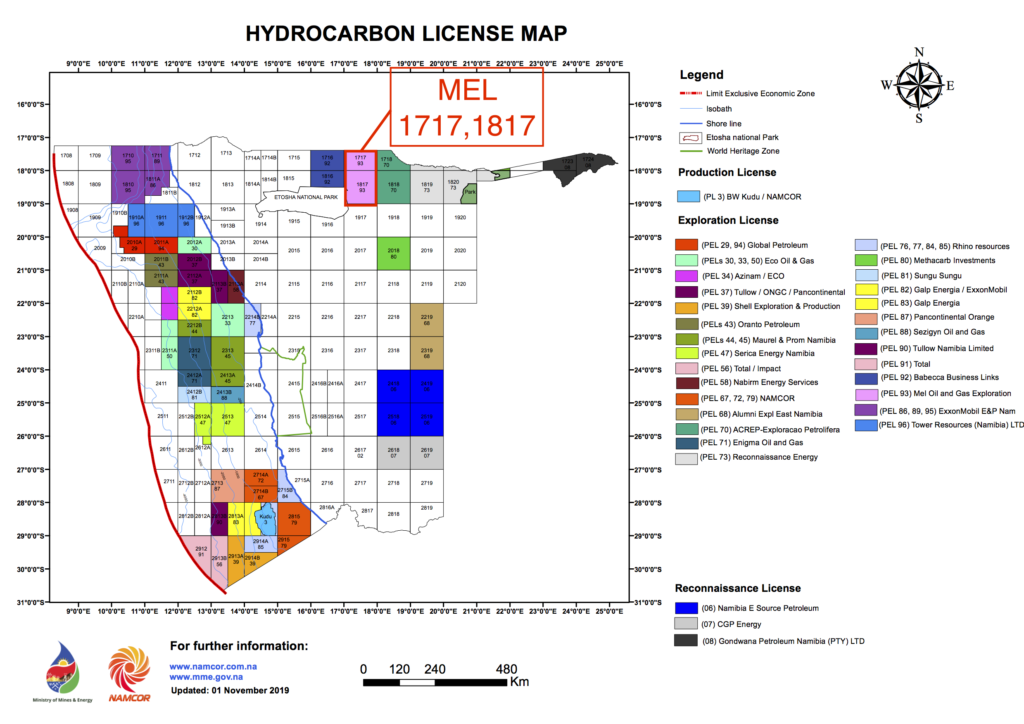

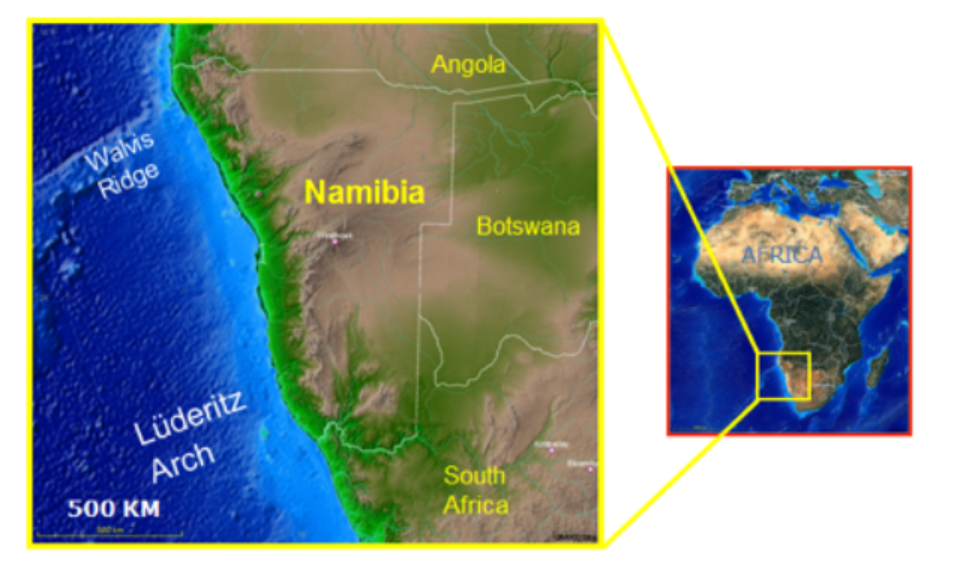

PEL 93

Basic Information

Blocks

1717 and 1817

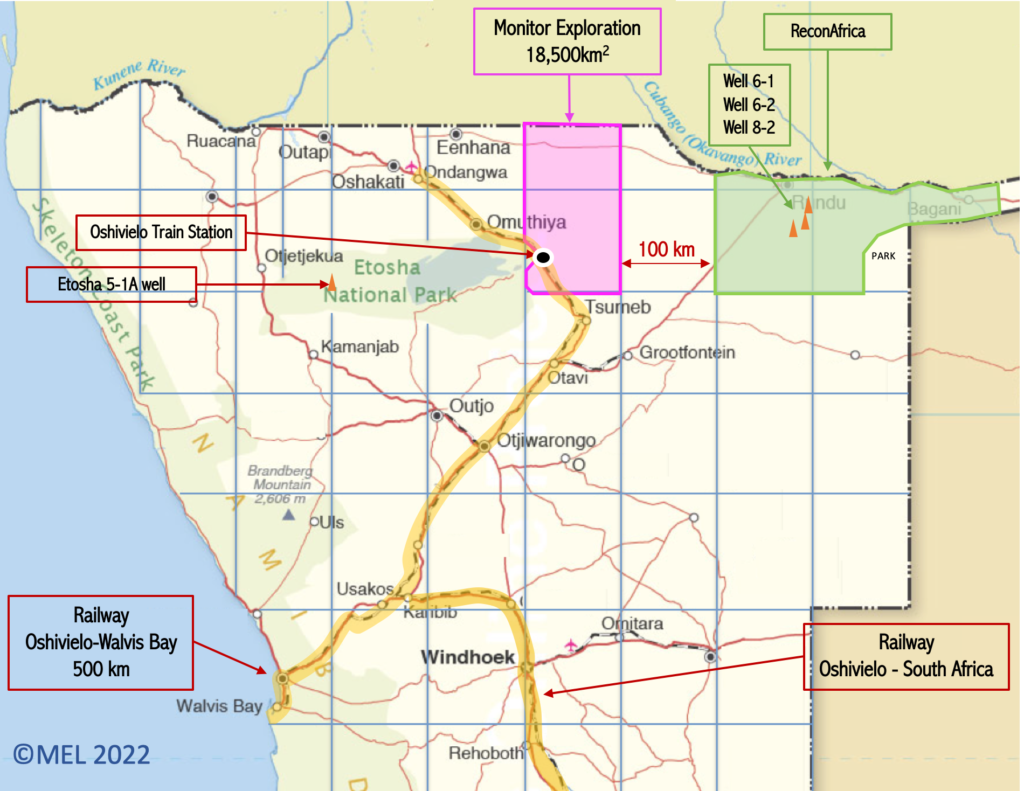

Area

18,500 km2 = 7,227 mi2

Location

Onshore Namibia, Owambo Basin

Petroleum Agreement Periods

Initial Exploration 4 years

First Renewal 2 year

Second Renewal 2 year

Petroleum Exploration License

55% Monitor Exploration

20% 88 Energy

15% Local Partner

10% State Oil Company Namcor

Current Period

First Renewal Exploration Period

2 years, until October 2025

Monitor are inviting investors to join us in exploring this emerging basin

2D Seismic Findings Confirm 11 Leads

Our objective is to complete high-grading work program and be ready to drill most prospective locations in 2026

Geological Setting

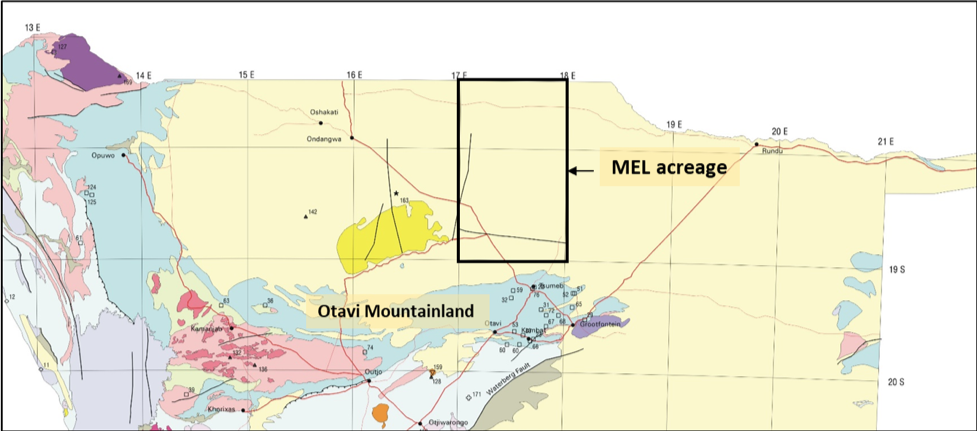

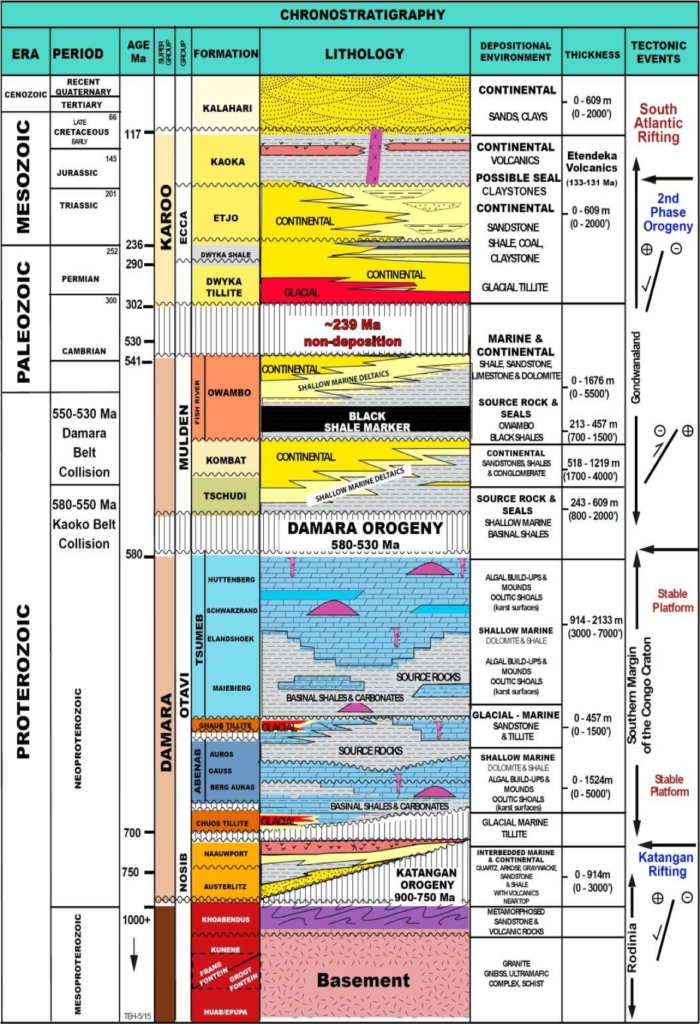

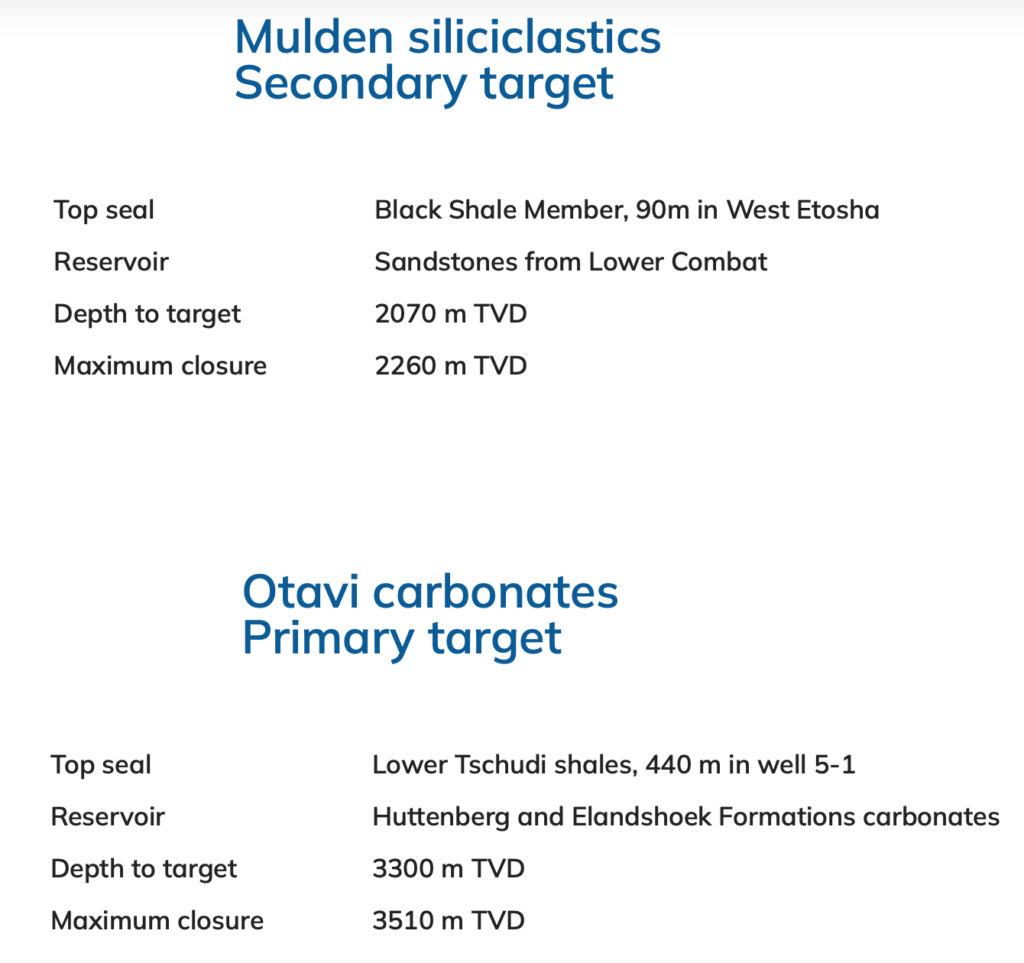

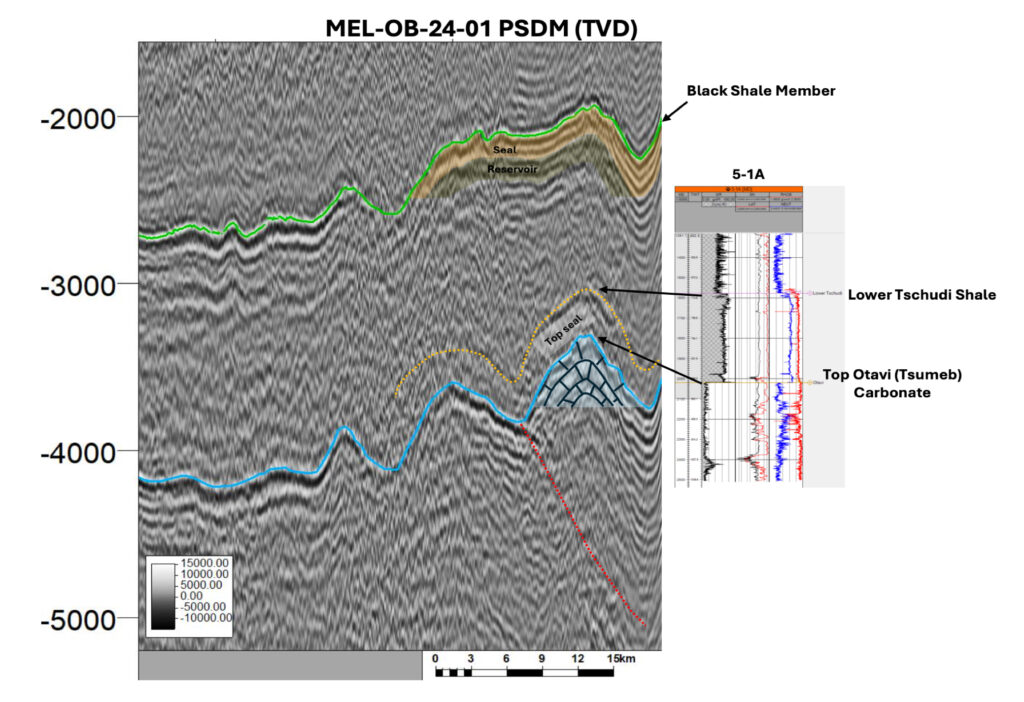

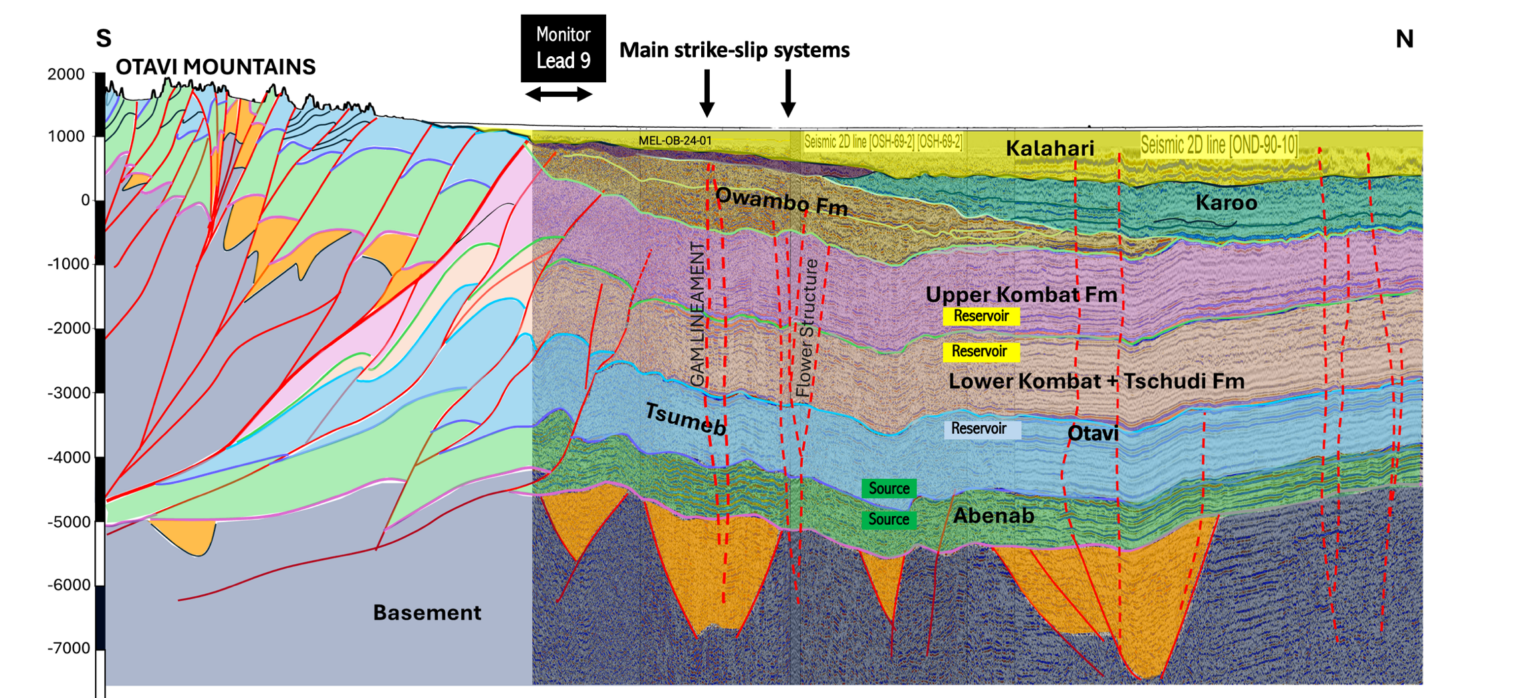

The Owambo basin is probably the most important area in terms of hydrocarbons exploration onshore Namibia. Its stratigraphy comprises rocks from Pre-Cambrian times till the Tertiary cover of the Kalahari Sands Formation with a total thickness up to 8000m. Otavi Group, a Neoproterozoic carbonate platform, represents the main target.

PEL 93 comprises the Damara branch of the fold belt towards the south.

Seismic data have revealed:

several large anticlinal structures with pronounced relief,

reservoirs in the Otavi and Kombat formations, and

access to source rocks of the Tsumeb and Abenab formations.

2D seismic acquisition has now confirmed the structural model which suggested the existence of large structural traps towards the southern portion of the block 1817

Prospective Recoverable Resources

Post Seismic Prospects

203 km of vibroseis 2D seismic data were acquired in mid 2024

The seismic supported several of the previously identified leads

Structural interpretation, including use of the dimensions and orientation of an analogous anticline which has been studied in outcrop to the South, has been completed

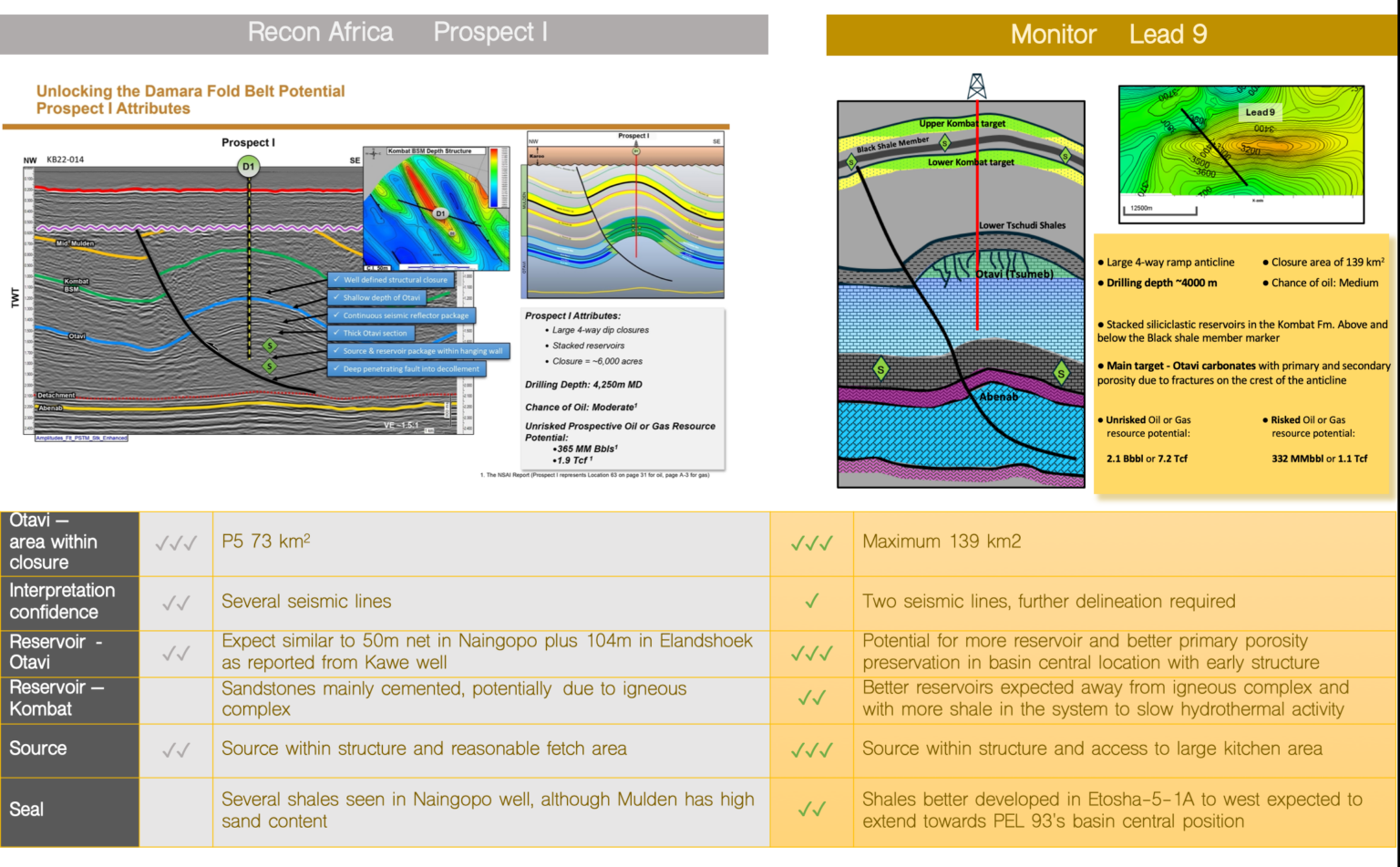

Comparison Recon Africa Prospect I vs Monitor Lead 9

Recon recently announced that they are changing their next drilling target to Prospect I which has the full stratigraphic section, including source rocks, within structural closure. This well is to spud in June 2025 and it is an excellent analogue for MEL’s Lead 9. Success on Prospect I would significantly de-risk the Owambo Basin and, in particular, our Lead 9.

Why Namibia

Why Namibia

- Politically and economically stable country

- Efficient Oil&Gas public sector: NAMCOR + MME

- Favourable tax regime

- Perfect climate for exploration, very long dry season

- Onshore underexplored

- Geological analogues to known oil basin, such as Oman

- Multiple oil seeps

- Distribution: 32% Urban, 68% Rural

- Neighbors: Angola, Zambia, Botswana, South Africa

- GDP: US$ 2.9 Billion

- GDP Growth: 2.7% Year

Doing business in Namibia

- Modern concessionary system with a

Royalty / Tax Fiscal Regime - Production Royalty = 5%

- Production Income Tax (PIT) = 35%

- An Additional Profits Tax (APT) is levied on

profits from a License Area - The “Ring Fence” on exploration expenditure is enlarged to include any License in Namibia for PIT purposes

- No Signature, Discovery or Production Bonuses

- Most Petroleum Exploration items are imported duty free

- Oil companies are exempt from non-resident Shareholders tax

Taxation

- Paid annually

- Levied at a rate of 35% of taxable income

- In the computation of taxable income, exploration and operating expenditures are written off immediately (at the time they are incurred) in full (100% depreciation)

- Development expenditures are depreciated over 3 years (33.33% per annum – straight line) and deducted accordingly.

Our Logistics Advantage

- Oshivielo train station – in the SE part of MEL’s licence.

- Walvis Bay is an important logistical port for the southern African region, with capacity to move 1 million containers a year, as well as an International Airport.

- Oshivielo – Walvis Bay : 660 km

- TransNamib offers specialised tank wagons for transporting of fuel and petroleum to all main towns and city across Namibia.

- Windhoek is the administrative, commercial, and industrial center of Namibia. It is also served by two airports.

- Oshivielo – Windhoek : 500 km

- Namibia’s railroad is connected to South Africa with regular cargo transportation between the countries.

The Petroleum System

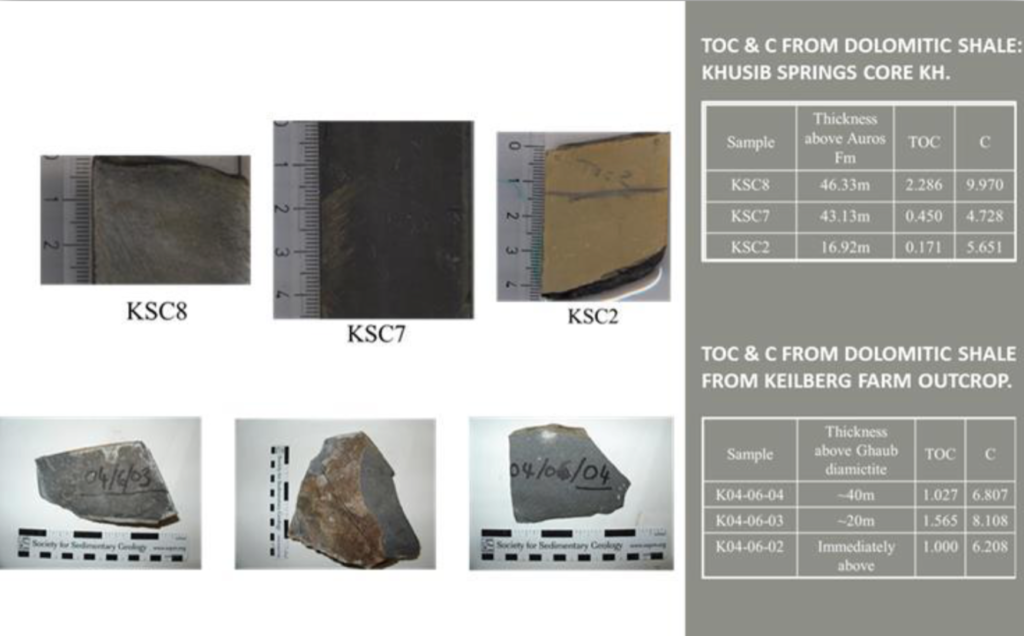

Source Rock

There is increasing evidence that deposition of many mid to late Neoproterozoic (to Early Palaeozoic) organic-rich units was triggered by strong post-glacial sea rise on a global scale, following the “Snowball Earth” type glaciations.

The source rocks with favourable generation potential associated to Otavi Group carbonates in Owambo basin should be distributed immediately to the north of Damara fold belt and to the east of Kaoko belt where the foredeep depozone of the foreland basin system developed.

Reservoirs

Potential reservoir rocks in the Owambo basin include Proterozoic carbonates of Otavi and sandstones of the Mulden group. Intra-Damara paleokarst structures may have lost of their porosity but various post-Damara episodes of karsting have produced cavernous porosity which is a major source of groundwater in the basin margins.

Porosity of Otavi carbonates ranges from 15% in logs and 21-37% in outcrops.High permeability in the upper most Otavi Group stratigraphic interval has been encountered in Etosha 5-1A wellbore.

Traps and Exploration Targets

Analysis and interpretation of available 2D seismic data over the blocks, have allowed the identification of four main types of plays within the blocks 1717 and 1817.

A. Ramp anticline: These are large anticlinal folds against thrust faults which have been recognized on gravity and magnetic data as elongated anomalies with SW-NE to the south of the thrust belt front. The anomalies are supported by the structural model defined for a fold a thrust belt. Similar structures have been confirmed by Etosha 5-1 well and seismic data to the west of the basin which are contained within the same structural trend as explained above.

B. Antiformal structures within the fore-bulge depozone: are located to the north of the thrust belt front and are formed due to the push down of the stacked tectonic sheets.

C. Carbonate mounds: mounded features observed on seismic data and outcrops. Stromatolites are the main reservoir units with excellent porosity and permeability.

D. Tectonic inversion anticlines: Anticlinal structures formed as a result of the tectonic inversion of rift-related faults. Nosib siliciclastics, Abenab and eventually Tsumeb carbonates form positive structures identified on seismic.

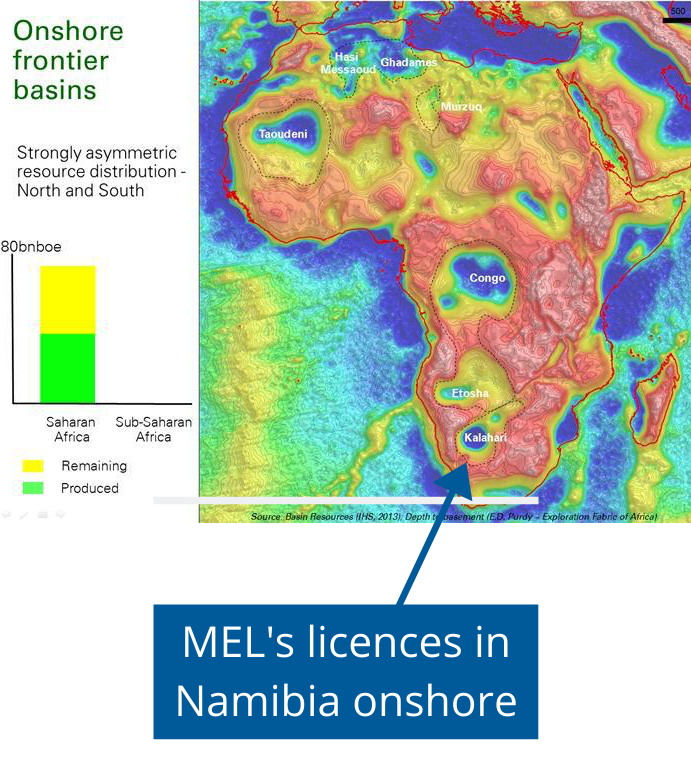

In 2019 BP's paper Energy Outlook classified Namibia as one of the three most prospective onshore basins, together with Congo and Angola, for future oil and gas exploration

According to one of British Petroleum’s speeches, held by Mr. Michael C. Daly, BP’s Executive Vice President Exploration, “Future Trends in Global Oil and Gas Exploration”, looking over the next 30 years, there are three potential sources of yet to find oil:

- Deepwater:

- Arctic:

- Re-exploration onshore:

- Onshore frontier basins

- Unexplored rock volume in established basins

- Tight oil in old giants

- Shale sweet spots

- Convergence with EOR

With the prospect of lower demand sooner than assumed at the time of his speech, and weaker prices for oil and gas, the risks and costs of the first two may make them relatively unrewarding in terms of returns for risk and capital involved.

On the third source, he particularly points to sub Sahara of Congo/Angola/Namibia as one of the prominent future prospects to follow. “Onshore, the remaining frontiers and deep land will follow with low cost, low impact, high quality seismic being key.”

Read the speech here.